From time to time the market gives us an opportunity to pickup some cheap investments. The challenge each of us has is to not be moved by the media. Those in power are well acquainted with the power of persuasion. Torture is persuasion on steroids. If you bombard people with a particular view, they will ultimately believe the view you are projecting. That is why it is so important to "hear" Our Heavenly Father and not be moved by the talking heads on TV.

Isaiah 55:8 For my thoughts [are] not your thoughts, neither [are] your ways my ways, saith the LORD.

The Book of Judges has a consistent theme: the people did evil in the sight of THE LORD, HE delivered them to their enemies, they cried out, then HE sent a deliverer. The U.S. has moved away from the principles of the Kingdom of God to the principles of Mystery Babylon. Usury and greed are the basis of the sub-prime mortgage crisis. Banks, credit card companies and other lending institutions are rationalized why it is good to keep us in financial bondage. They removed prudent lending practices to ensnare the average person in loans that at best will barely be repaid. The "Me" generation is quickly moving toward the day of reckoning. It appears that we are on the same course as in the Book of Judges. We are shipping over $400 Billion to other countries, some who are potential enemies. We are paying for their rise to power. We may be crying out to THE LORD by 1/11/11.

In the meantime, for those who believe that their party will end, the last few days have provided some notable investing opportunities. Gold dipped to the $870 level. It sent gold stocks down. A good example of a gold stock with great potential is Minefinders:

Minefinders is expecting to begin production within months. The stock is closely held and the management acted responsibly when raising money during the exploration phase. (See disclaimer on website). I have invested in this company. This is not a core holding as would be Goldcorp or Yamana Gold. However, this stock has dramatic upside potential. Greater risk but greater reward potential.

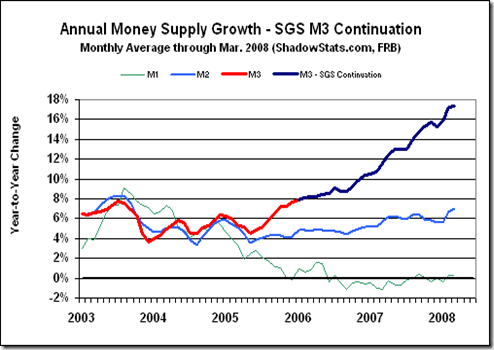

Gold and silver bullion were a buy this week. $870 gold and $16.50 silver are looking cheap now. Higher energy prices will force metal producers to keep prices higher. Miners will shut down mining if costs exceed prices of their products. They have done this in the past. This creates a floor for metals prices. China continues to play a major role in prices. Their new middle class will have a ravenous appetite for goods and services that the West has been accustomed to. Their meat consumption will rise. It takes a lot of grain to feed cattle. Moving from a vegetarian diet to include meat will have an inflationary impact on global food prices and supply. Americans MUST start thinking globally. The American-centric world has come to an end. U.S. companies with employees in other countries are being pressed to pay those employees in Euros or Canadian Dollars. Those employees are losing purchasing power when paid in U.S. Dollars.

Yamana Gold has had a 33% retracement in price. From a technical point of view, that is a good buy signal:

I expect gold to push towards $1,600 and beyond. Yamana and other gold stock are expected to enjoy the ride up. Goldcorp continues to be a solid stock. Review of their annual report reinforces my view of their potential.

I expected the natural gas price to take a breather by now. I was wrong. Its continued strength simply confirms our view of production declines with increased demand. Coal is out of favor. Power companies are starting up their natural gas fired turbines in preparation for the summer heat. Some of these turbines had been in "moth-balls". My original 4.25 price floor for natural gas is up to 6.50 now. However, we might not see 6.50 again in the next few years.

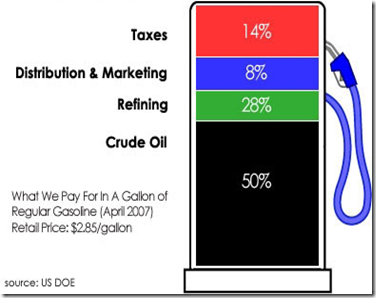

I had projected $125 oil earlier. $150-160 oil is looking more probable and sooner than I originally thought. Those who have invested wisely should consider helping those loved ones who are hurting due to the gasoline/energy prices. In OUR FATHER’S great grace and mercy, our investment successes are to sustain us and those around us, not just "me and my four and no more".