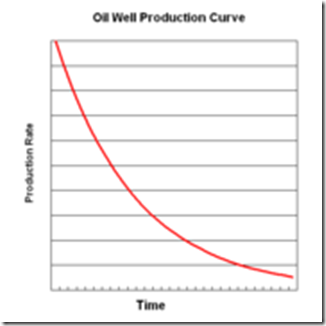

To borrow the phrase used by Bill Clinton, "It’s the economy, stupid!" Much has been written about the recent rise in energy prices. Many writers quote other writers, government reports, and industry statistics. What most do not consider is overall supply. Having first hand knowledge of oil well depletion curves helps one to understand the nature of the problem. Generally speaking, the depletion curve of an oil well looks like the following:

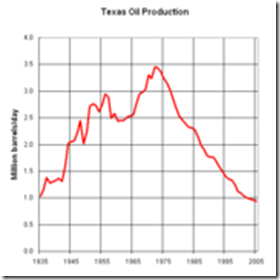

Your best production occurs when the oil well initially produces. You can stimulate the producing zone and get a second uplift on the curve, but over the long run this is the curve. Once the well is producing, you will normally develop the field that it is in and create a more complex production curve:

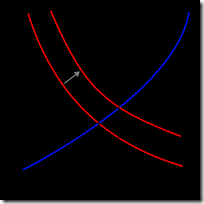

The Texas Oil Production Curve is a good representation of fields around the world. The main difference is the size of the field. If you put all of the oil producing fields together, they might look similar to this graph. Why do we care? In basic economics we have a supply & demand curve. The basic supply and demand graph would indicate as demand increases, causing a price increase, new supply would be brought into the marketplace. This assumes that supply is unlimited over time. The following graph depicts this:

Price

The blue line indicates supply will increase as demand (red line) shifts.

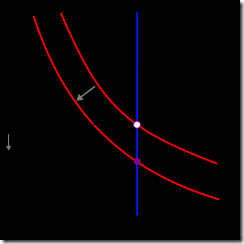

The following graph illustrates if supply is fixed:

Price

If demand decreases (to the lower red line), the price falls. However, if demand increases, there is a sharp increase in the price. Today’s demand for oil is 87 million barrels per day. Today’s supply of oil is 85 million barrels per day. This 2 million barrel deficit is causing the increased price of oil. Additionally, the U.S. Dollar has been declining against other currencies:

If your currency depreciates by 25%, the cost of a global commodity goes up by roughly 25%. If the U.S. Dollar retained its January 2006 value, oil would be priced at about $97.50 per barrel now and we would be paying about $2.78 per gallon for gasoline.

The 2 million barrel deficit is being made up by existing inventories. Inventories in the U.S. have declined to 2003 levels. However in the last 5 years, oil demand has increased. Former exporting countries such as Great Britain and Indonesia who provided 1 million barrels of day are now importing oil. Mexico’s oil production dropped 13% this year. Mexico is the 3rd largest exporter to the U.S.

The balancing factor to these reduced supply factors is the price. Increased prices forces less demand resulting in the movement of the price curve downward toward the supply coordinate. Classic economics and Western thinking assumes unlimited supply. Today we have limited supply. I know there are those who argue that big oil companies are conspiring to withhold supply, technologies, etc. The big oil companies have less than 15% of the world’s supply of oil. State run oil companies have the other 85%.

Other technologies have a promising future. However, ramping up these technologies will take years before they will substantially impact the current supply dynamics. You don’t replace 200,000,000+ U.S. vehicles overnight. Currently, the most scalable solution at our disposal is nuclear. Without nuclear power, electric cars will be a poor alternative. It is known among scientists that there is virtually unlimited energy tied up in atoms. They understand the theory but have been unable to convert the theory into a realistic fuel alternative.

Until the revelation/baptism of Love comes corporately, I believe that the revelation of cheap energy will be withheld. Love gives. The "love of money" takes and is never satisfied. Free energy would drastically change the economic climate around the world. I believe that Our Heavenly Father will not allow this revelation to be "bottled and sold" by the moneychangers. It appears that the global community will suffer until there is a corporate movement to turn their attention back to Our Creator. A cleansing period is ahead and the supply of energy will be the catalyst for refining!