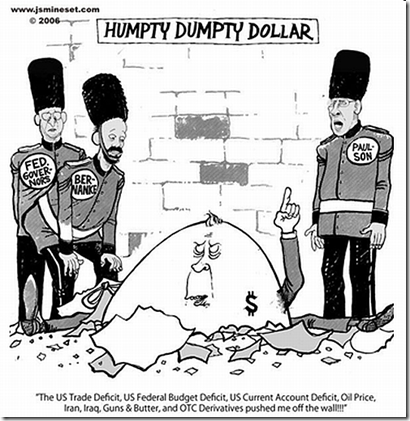

If you think $700 billion is enough to resolve the financial crisis, you are sadly mistaken. The government’s estimate is the initial payment to start dealing with the flawed financial business model. The underlying derivatives will be observed by all of us to truly be financial weapons of mass destruction. Washington Mutual, a 119 year old company with $307 billion in assets, is by far the biggest bank failure in history. Stockholders and most bondholders will lose their entire investment. WaMu participated in a substantial number of credit default swap instruments. The counterparties will be forced to take a loss against their capital structure.

What is a credit default swap?

A credit default swap (CDS) is a credit derivative contract between two counterparties, whereby the "buyer" or "fixed rate payer" pays periodic payments to the "seller" or "floating rate payer" in exchange for the right to a payoff if there is a default[1] or "credit event" in respect of a third party or "reference entity".

If a credit event occurs, the typical contract either settles by delivery by the buyer to the seller of a (usually defaulted) debt obligation of the reference entity against a payment by the seller of the par value ("physical settlement") or the seller pays the buyer the difference between the par value and the market price of a specified debt obligation, typically determined in an auction ("cash settlement").

A credit default swap resembles an insurance policy, as it can be used by a debt holder to hedge, or insure against a default under the debt instrument. However, because there is no requirement to actually hold any asset or suffer a loss, a credit default swap can also be used for speculative purposes and it is not generally considered insurance for regulatory purposes.

What happens if the "insurer" cannot perform? The underlying asset becomes worth less. If the holder of the asset is required to "write down" the value of the asset, it is a direct hit against the capital of the the counterparty. It can create insolvency and it will do so to many smaller counterparties and hedge funds. Nobody knows the impact of the failure of WaMu and that is why Treasury Secretary Paulson wants a "blank check" from Congress.

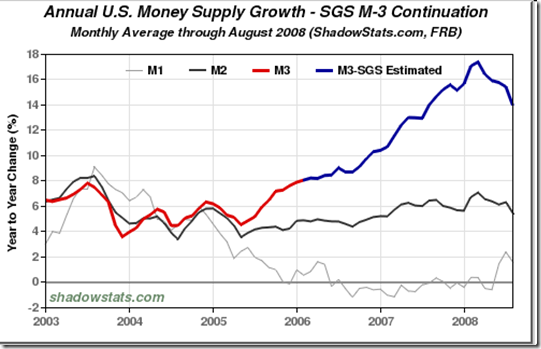

If we could get a transparent audit of all the losses resulting from this crisis, I believe the total will be between $4 Trillion and $25 Trillion, if not more. It will get ugly soon. There is no way out because the current decision makers know no other paradigm. The current system feeds upon itself and by definition protects and perpetuates itself. Interest rates have been lowered to allow these very institutions to re-liquify by transferring the wealth of savers to the financial institution’s balance sheet.

A new business model based on love will be necessary to resolve this crisis. The current greed-based model will fail soon.