There should be no question that Wall Street with the aid of the last two Administrations (both political parties) and Congress have sowed seeds of financial mass destruction. Bill Clinton promoted sub-prime lending and strong armed banks to comply, Congress wrote law omitting credit default swaps (CDS) from being classified as insurance thus promoting exorbitant leverage and reckless financial instruments to be distributed globally, and the Bush Administration kept the party alive. The party is over and there is a mess to clean up. The decision has been made to sacrifice the taxpayer rather than the corporations that were complicit in creating the problem. Where were the independent thinkers? Why did no one pay attention to Warren Buffet’s warning about the financial weapons of mass destruction when he bought a company and analyzed the problem on March 4th, 2003?

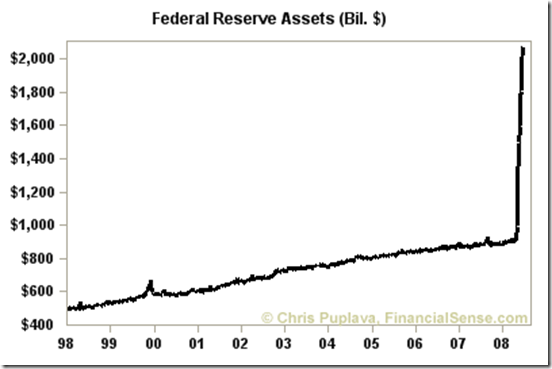

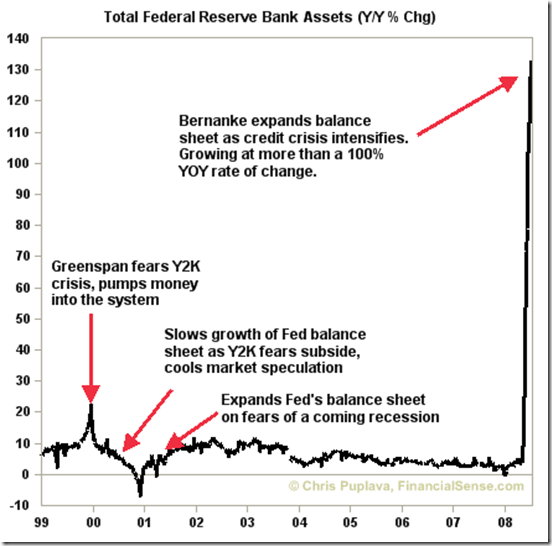

The U.S. Treasury and the Fed will create new money to deal with the evaporation of capital and it will create a tsunami of oncoming US Treasury debt. This will 1) crowd-out private sector funding of debt, 2) force the US Treasury yield curve to steepen, 3) put downward pressure on the real economy, 4) undermine the US’ AAA rating, 5) and weaken the US dollar.

Other countries really want out of a dollar denominated world. They have been bamboozled by the U.S. and Wall Street. We have seen the repercussions of a poor monetary policy in other countries never considering it could happen to the U.S. The seeds of greed, power, and the love of money have been sown.

Last week, the morning after the election (November 5th), I started a blog titled "666" but kept delaying its completion. Later I read a blog at http://www.gods-kingdom-ministries.org/weblog/WebPosting.cfm?LogID=1229 where the number popped up in Barak Obama’s home state of Illinois. If you have been reading my earlier blogs you may remember that I am focused on 1/11/11 as being a "watch date" for an economic event, the culmination of the perfect storm, or the beginning of a new era. We shall see. We are 25 months away from this date and it currently appears that the perfect storm may happen then based on the actions being taken by world leaders. It is time to get your house in order.

Consider and ponder the following words of Jesus:

Luke 6:35-38

"But love your enemies, do good, and lend, hoping for nothing in return; and your reward will be great, and you will be sons of the Most High. For He is kind to the unthankful and evil.

"Therefore be merciful, just as your Father also is merciful.

"Judge not, and you shall not be judged. Condemn not, and you shall not be condemned. Forgive, and you will be forgiven.

"Give, and it will be given to you: good measure, pressed down, shaken together, and running over will be put into your bosom. For with the same measure that you use, it will be measured back to you."

Our Heavenly Father created a global equilibrium. The Spirit resides everywhere, there is no void or nothingness on earth. Each of us prays to The Most High God without regard of time or space knowing that He hears our prayers. Jesus commanded us to give and assured us that the giving would be fruitful. If you sow judgment, you will reap judgment, if you so condemnation, you will reap condemnation. However, if you sow love, you will reap love.

The funds my wife and I have represent our fruit of working, saving, giving, and discerning what and where to distribute. There is a tendency to dwell on the bad news and hoard, an act of fear. Our Heavenly Father promoted buying and selling of goods. Jesus spoke of this in the Parable of the Talents. Jesus also promoted giving motivated by love. In recent decades the "church" has misused the Scriptures in order to extract and exploit the congregation. Frankly, it left a bad taste in everyone’s mouth. Further, it gave people an excuse not to give, due to the abuse. It is time to shed that mentality. There are people hurting and in need.

Servias Ministries was set up as a conduit for giving and receiving, often anonymously. We have people and projects that need money. We distribute 100% of all contributions received. Our Officers and Directors pay for all administrative and operational costs. We are not interested in exploiting the poor and hungry, we give to those in need. We have a special heart for children as did Jesus. If you are interested in sending your tithe and/or charitable contributions to us for distribution, we would welcome your participation. Sowing in Love produces good fruit. To send a contribution of any amount, mail it to:

Servias Ministries, Inc.

PO Box 1471

Bethany, OK 73008

At yearend we will send a summary contribution letter for tax purposes.

The coming era will be motivated by love, not lust. The lust of the current era will be judged by Our Heavenly Father and be corrected in the appropriate fashion. We will continue to give in love expecting love to grow and consume the earth.