November 15th, 2008 may go down in history as the beginning of the end of the U.S. Dollar’s global supremacy. The G20 nations will meet and discuss the global financial crisis. Since the Bretton Woods Accord, the Dollar has operated as the global reserve currency, the currency of business.

In 1944, the Bretton Woods system of monetary management established the rules for commercial and financial relations among the world’s major industrial states. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent nation-states. Preparing to rebuild the international economic system as World War II was still raging, 730 delegates from all 44 Allied nations gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire, United States, for the United Nations Monetary and Financial Conference. The delegates deliberated upon and signed the Bretton Woods Agreements during the first three weeks of July 1944. Setting up a system of rules, institutions, and procedures to regulate the international monetary system, the planners at Bretton Woods established the International Bank for Reconstruction and Development (IBRD) (now one of five institutions in the World Bank Group) and the International Monetary Fund (IMF). These organizations became operational in 1945 after a sufficient number of countries had ratified the agreement.

The Russian Rouble has depreciated in value and the Russian Central Bank has raised its key lending rate to 12% to strengthen the currency. The U.S. cannot do that without thrusting the U.S. into a deep depression. What is the alternative for the U.S.? A devaluation of the Dollar. As the world’s reserve currency the Dollar needs to show stability. This was accomplished by pegging the Dollar to gold for 25 years until Richard Nixon took us off the standard. Without a firm relationship with gold, a fiat currency is destined to depreciate which causes the economy to hyper-inflate. Your dollars will be worth less.

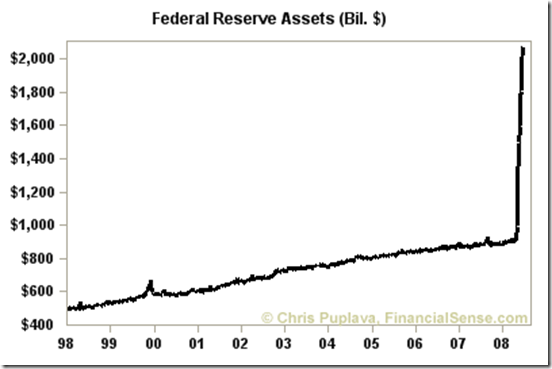

What is the solution? The U.S. Dollar should be pegged against gold again. The equilibrium price is currently between $3,000 and $5,000 per ounce. However, that will change as the Federal Reserve continues to create money out of thin air… mighty thin air! The Gold Ratio would then create stability and other currencies would begin to reach an exchange rate equilibrium. I don’t see any other acceptable solution for all parties holding U.S. Dollars. Other alternatives are failing thus the need for a "G20" meeting. The following graph provides a perspective of the Fed’s actions:

What do the following have in common:

Freddie Mac, Fannie Mae, AIG, GM, Ford, Chrysler, American Express, Wall Street Investment Banks?

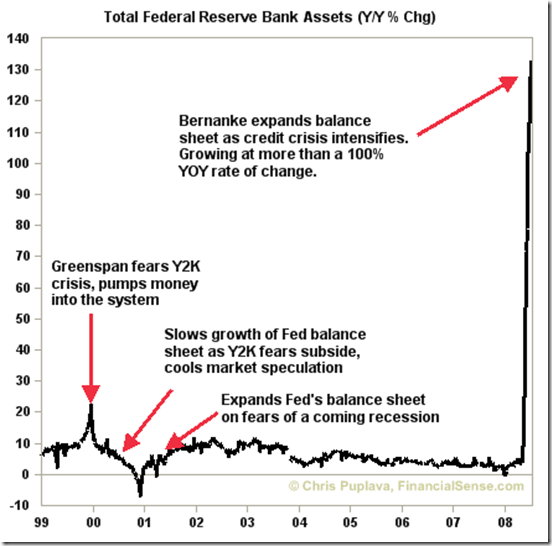

They all need cash and are going to the Fed’s begging bowl. The following graph provides a look at Greenspan’s crisis vs. Bernanke’s. What a difference in the magnitude.

Gold and silver are both depressed from the de-leveraging and selling of assets to raise cash. Let us not forget the continued manipulation efforts to keep the true barometers of financial health from skyrocketing. Once the general public has figured out that the only solution left for the leaders is to devalue the U.S. Dollar, there will be a buying tsunami of gold and related gold stocks. The manipulation, illusion, and deception will cease.