America is now in a window of "crisis". Financial TV talking heads are telling us the worst is over as they look from inside the eye of the hurricane. They are attempting to spin every piece of bad news into good news. I believe it is their heads that are spinning. There is so much going on, how can the average person view the big picture? Only the God of Heaven and Earth knows!!! America has a monstrous ego. The ego is illusionary at best. The Lord God Almighty has used this country in the past but it appears that judgment is ahead. America’s protective covering was lifted at 9/11 if not before. Rather than repent, the country is fighting wars on two fronts- the war against terror. Who is against us? It is anybody that fits the definition defined by those in charge. The rule of law appears to be broken. The country is reflecting the hearts of the people. All people? Surely not. Only the majority.

As time passes, the theory that the U.S. invaded Iraq for its oil reserves appears to have more credibility. The war has now surpassed WWII’s length. The cost of the Iraq war in American lives, caring for the wounded, and financial impact is staggering. Are we going to expand the war to Iran? During President Carter’s Administration the primary issues were Iran, Afghanistan, and inflation. Déjà Vu!

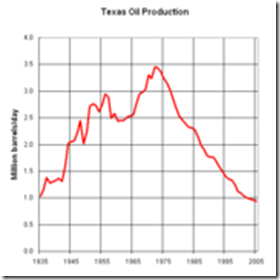

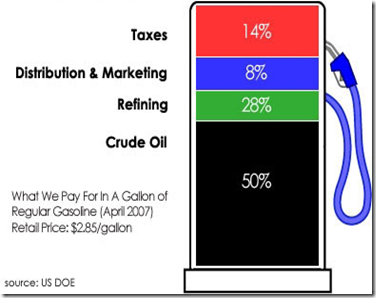

Energy prices have hit and surpassed my short term target of $125/BBL for oil. What many don’t realize it that the $11+ natural gas prices will show up on your electric bill soon. The Green Machine (Environmentalists) has swayed the American public to attack coal as an energy source. Requests for new coal powered generating plants for electricity are being rejected state by state. Coal is currently our cheapest energy source for electricity.

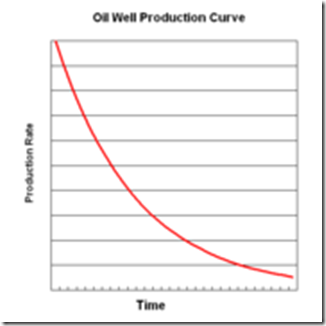

The average American will be hit hard this summer by gasoline prices. We have been in the "shoulder" season when oil producers switch from winter heating oil demand to summer driving demand. Historically the price for oil would drop during this time. Further declines in the value of the dollar and oil production as well as increased demand from China and India have kept the price robust. The era of cheap energy from oil is at an end. I recommend trading in your SUV for a Prius or Civic if you can afford it.

Food costs will continue to increase. We have seen a glimpse of the crisis in the recent upheavals in lesser developed countries. People need food, shelter, and clothing no matter what country they are in. The cost of energy to produce and distribute grain has caused food costs to increase by 10-50%. Home gardens will once again gain popularity as the average person will feel the need to find alternatives to the high cost of groceries. Restaurants are already feeling the pinch of inflation. In some areas, restaurant revenues are down 30% compared to last year.

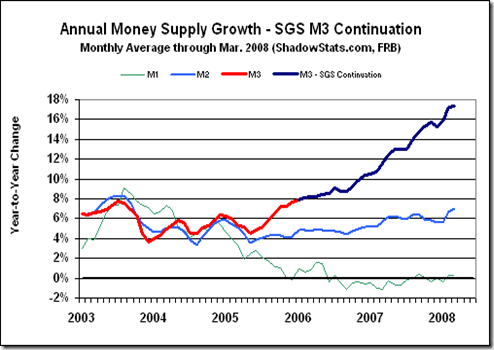

Interest rates are upside down relative to inflation rates. 8-10% inflation compared to 1-3% savings interest rates are causing elderly savers to be punished. Each year they are losing 5%+ purchasing power. Social security increases are intentionally tied to a lower index than reality so the government can save money. This is another example of unequal weights and measures.

I have noticed that the American people are always "too busy". A great example is the phenomenon of little league baseball. When I was young I played baseball in the local YMCA league (the only league in town). We had twelve games in the season. Our parents came to the game. Mom was scorekeeper. Dad was assistant coach. We practiced every weekday during the 12 week season when we didn’t have a game. Nowadays little league teams play 40 to 50 games with out of town tournaments. The season starts earlier and ends later. The egos of the parents push these poor kids into "burn-out". This is about to change. The Sabbath has been watered down to a point where the day of intended reverence and reflection no longer exists in our society. Man has been "doing what is right in his own eyes" as he did in the Book of Judges. Since this era of cheap energy is ending, fifty game seasons for those little leaguers will be pared back to a reasonable season. Less travel means more time to reflect. This time of "busyness" will be replaced by a time of repentance.

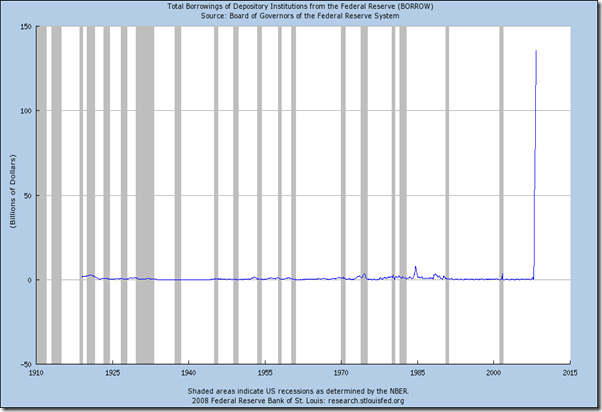

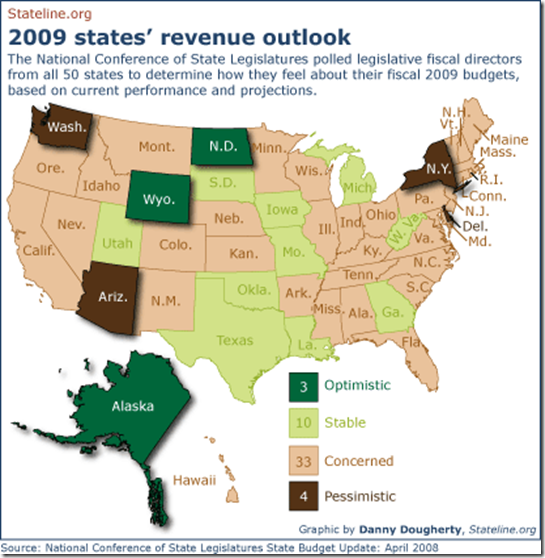

Compared to our Gross Domestic Product (GDP) our personal debt level exceeds that of the Great Depression. Financial entities have been predatory towards those who are ignorant of personal financial principles. Young people are targeted for credit cards. Generally, they have no business carrying a credit card. At a recent high school graduation, the keynote speaker urged the graduates to pay cash for purchases and stay away from the trap of buying on credit. I was expecting to hear the normal "shoot for the stars" motivational speech. Congress has helped to put us into this mess. They eliminated our tax deduction for consumer credit thus moving people towards tapping into their home equity for borrowings. With this larger pool to pull from, consumers responded by increasing their debt. Congress virtually eliminated the "jubilee" aspect of bankruptcy. Who do you think lobbied for that change in the law? The financial institutions, of course! This nearly guaranteed the credit card companies reduced write-offs. In the past, their justification for high interest rates was the expected write-offs due to bankruptcies clearing cardholders’ debt. The laws changed but the rates did not come down. I suspect that judgment will come to those who exploited the uninformed and immature borrowers. Personal incomes have not kept up with the increased prices of housing, vehicles, and food. The consumer is less able to weather a downturn in the economy as in previous times.

Alternative energy has no silver bullet for us. Scalability is the issue. For instance, used cooking oil can power a vehicle. However, if everyone demanded the cooking oil, we don’t have enough supply for the country. Water can be used as fuel for a car. However, fresh water is in short supply. Some states are fighting over the fresh water currently available. How many autos can tap into the current fresh water supply before you have a water crisis? Tap water in some areas is corrosive to metal. Could an engine last for 100,000 miles with this corrosion issue? Americans have been buying about 17 million vehicles per year. There are about 250 million vehicles in the U.S. It would take 15 to 17 years to replace the vehicle fleet in the U.S. If a silver bullet did surface, it won’t help the next 36 to 48 months. New refineries can’t be built within the next 48 months. New oilfields can’t be fully developed within the next 48 months. New power plants can’t be built within the next 48 months. Leadership has been asleep at the wheel and Congress has failed to make the hard decisions in favor of pork barrel pet projects that don’t consider the big picture.

Our Heavenly Father has a plan. It is being implemented. Look to HIS guidance. Walk according to HIS precepts. As you line up with THE FATHER’S plan, you will prosper during this time of crisis. After all, HE is not obligated to answer the prayers of your ego, he will only answer the prayers of your heart. The next 36 to 48 months will tell the tale. Pray!!