What is a Business Model? A business model is a framework of creating value by a company.

What is a framework? A framework is a basic conceptual structure used to solve or address complex issues.

Source: http://en.wikipedia.org/wiki/Business_model#Do_Business_Models_Matter.3F

Now that I have defined the business model, let’s look at the relevance of this topic to Biblical Economics and Love.

VALUE!

Four years ago, we bought a high-end digital television from BestBuy as a family Christmas present. The salesman urged me to buy an extended warranty. I agreed knowing that new technology tended to have “bugs” and I didn’t want a negative experience one month out of factory warranty. He indicated that the one working part (the lamp bulb) could burn out and justify the extended warranty. I took the bait. Anytime I look at extended warranties I look at the probability of the company remaining in business over the life of the warranty. After all, serviceability is the backbone of an extended warranty. I had a total of four years ending December of 2008 to test this “Value Add”.

It happened! The lamp bulb finally burned out. I pulled my paperwork and manual from the file, so much for simplifying my life. I have to keep a file with manuals for all of the electronics in insure that if the device fails, I have my receipt, a copy of the warranty, etc. Uggh! BestBuy suggests that you go to their website for Warranty customer service. No way! As an Information Technology professional I know that they want me to do all of the work. How do I know whether or not their website will freeze up just before I press the critical button? I called their 800 number, I am taking no chances on finally using this extended warranty.

When I connected to their warranty service I immediately was connected to a live person, just kidding! I went through their automated telephone directory “people barrier” system. If you have the resolve to navigate through this system, they will talk with you. After a few minutes of being on hold, I finally spoke to a customer service person. Hallelujah! After I explained that my TV needed a bulb (based on the manual’s problem analysis page), she directed me to the parts department. While on hold, They had me listen to their recording boasting of maintaining over 7,000,000 parts in inventory. Wow! I was sure that this was going to be worth the wait. After 8-10 minutes of being on “hold”, the parts person finally picked up my call. Once again, they brought up my record after I gave them my 10 digit extended warranty #. This was not enough. He wanted my serial #. Wait a minute, don’t they keep that information on file? Oh well, after retrieving my trusty flashlight and magic reading glasses, I was able to locate the serial # in the dark abyss behind my TV where a thousand cables reside. @#$%^*, there it is! Armed with my serial # I returned to the phone. In my manual, the model # of the bulb was mentioned. Obviously Sony knew that this bulb was going to fail. I wonder why they didn’t include an extra? Anyway, the parts representative agreed with me on my bulb’s model #.

Now came the surprise: “We will ship you the bulb 4-6 business days“. What? The bulb is not close by? Knowing that most large companies can ship in 3 days, I pressed the guy on the other end. Why don’t you immediately ship it? He said that they must get the bulb from the manufacturer. WHAT ABOUT THAT 7,000,000 part inventory???? I spent $$$$ for this high dollar TV and you don’t stock the bulb? Gimmee your supervisor.

After 4-5 minutes on hold again, the supervisor re-explained that they don’t stock the part and must obtain it from Sony. However, she indicated that if I was able to buy the part myself, they would reimburse me for the cost of the part. After much frustration, I asked to be returned to the parts department. They had not given me any tracking information and I needed to be sure the part was ordered. Once again while on hold they were rubbing those 7,000,000 parts in my face. After 8-10 minutes of the recording with an interruption indicating that the “next available representative would be with me in 2 minutes” four times, I spoke to another parts person. She found my order and gave me the tracking information. She assured me that I would receive an email confirmation. So, at the end of 45 minutes, I hung up.

I wondered…. I think that I will google that lamp bulb on the Internet and see if I can get it here sooner. In five minutes, I found the bulb. The company had 18 Sony bulbs in stock and they could ship it out today (Saturday) and I would have it in 3 days. What is wrong with this picture?

BestBuy’s business model contains serious disconnects. This issue is not unique to BestBuy. IBM’s administrative red tape defies understanding. One customer can have multiple customer numbers and customers have complained for 30 years about the problem. Our largest newspaper in the state is converting to a new system and we were immediately past due on our bill that we have paid on the same day of the month for 15 years. The new software did not use the same business rules as the previous software.

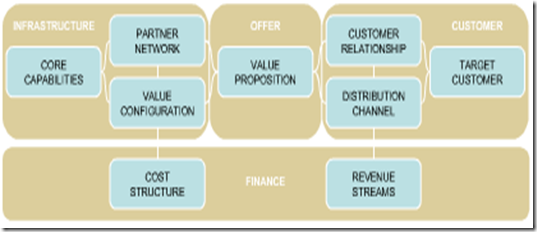

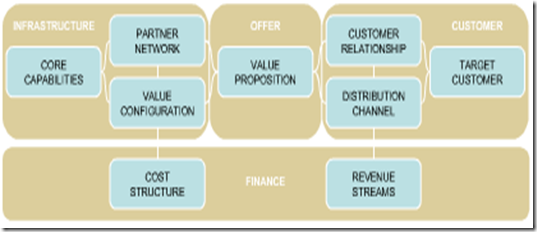

America’s business model is breaking. When I was inquiring of The Lord, HE indicated that this would continue and that I was to accept this as a warning of things to come. I didn’t bring up the topic, HE did. The above experience is the symptom. I found that BestBuy was using a 3rd party to fulfill the parts needed in the Extended Warranty program. I was not talking to a BestBuy employee. In the above diagram, “the partner network” was being used for this function. The theory was good, the reality stunk! As more consumers get exposed to these breaking business models, sales will decline. Simplicity will once again prevail. People will walk away from the complexities of today’s environment.

There has been a mismatch of gifts and callings with employment. There are those who are called to run businesses based on the principles of love, not greed. Those people will be raised to leadership roles as the greed is cleansed from the system. Current business models serve the corporation and its executives’ bonuses, not the customer.Who will cleanse the system? Our Heavenly Father. HE will install HIS business Model- Love! Rather than exploit consumers, businesses will serve consumers. At that time, customer SERVICE will return. Until then brace yourself.

PS. When I opened my email confirmation from BestBuy, they were shipping me a Philips bulb, not a Sony bulb.

PSS. After posting this, I went to activate my new Citibank credit card used in my business. I went through all the automated steps, was redirected to a live Rep. She apologized for their system being down and please call back in a few hours.