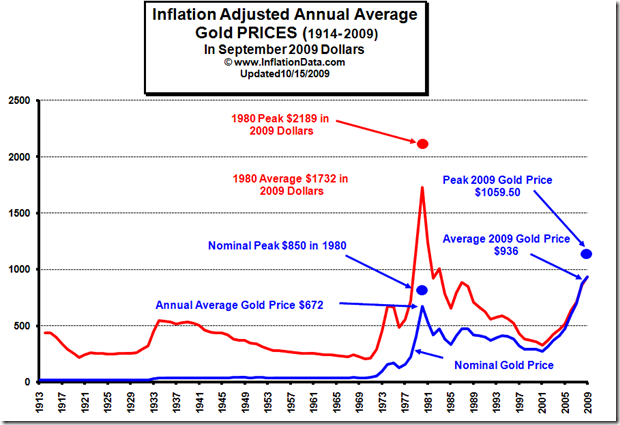

The answer is: No, not in terms of inflation-adjusted U.S. Dollars.

The price would need to hit $2,190 to be a true new high. I expect this to occur by December 21st, 2012 or earlier. As the BRIC countries increase their per capita income, new demand to hold gold will cause the price to surge. $5,000-$10,000 price range during the mania would not be unexpected. Silver will enjoy the ride as well. However, the central governments will attempt to reign in the price so one would expect a battle in the gold pits resulting in price volatility. Do not borrow to buy gold.

Notice in 1971 when we went off the gold standard, monetary inflation became unrestrained. With a $1.4 Trillion deficit, the decline in the value of the dollar is assured. The Fed cannot raise interest rates to support the value of the dollar without putting the banks and the economy at risk.

Disclaimer: The material on this website has no regard to the specific investment objectives, financial situation, or particular needs of any visitor. This site is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments.