Energy

Oil prices are at $77. Oilfield depletion continues whether the global economy is in a recession or not. New oilfield discoveries are in a steady decline despite the advances in technology. There is insufficient new production coming online to offset these factors as global demand is increasing. China has recognized this critical issue and has been acquiring oil reserves around the world by deploying their U.S. Dollar cash reserves. Western governments and agencies have failed to act after the U.S. Geological Survey in 2005, reduced their global oil reserve estimates by two thirds- from 939 billion barrels to 334 billion barrels with a 95% confidence level. 95% of transportation and 95% of food production rely on oil. Alternative energy sources will not address this reality in the short term. In a report last fall, the IEA reviewed 800 oilfields and increased the estimated depletion rate to 6.7%. 17 of the 20 largest oilfields in the world are 40 years old or older. Since 2005, conventional oil production did not increase even when the price spiked to $147 per barrel. This clearly indicates that the world’s oil producers are unable to sustain the current levels of supply with decline rates eating away at their annual production numbers. Over the next decade, conventional oil production by existing fields will drop 50%. See: http://www.iea.org/weo/docs/weo2008/WEO2008_es_English.pdf Page 8. Conventional oil production is currently 74 million barrels per day and is expected to drop to 37 million barrels per day by 2020. What will make up the difference? Non-conventional oil from sources such as the Canadian tar sands have a more expensive break-even cost per barrel. Prices will go up even though demand destruction may occur. It is basic Economics 101 theory. $147 may look like cheap oil soon.

U.S. Dollar

At this writing, the price of gold hit $1,100 and it is not over yet. Gold is the barometer of the decline of the U.S. Dollar. The U.S. Dollar index is a basket of currencies valued against the dollar:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY), 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight and

- Swiss franc (CHF) 3.6% weight.

Notice that the Euro has the greatest weight. When the dollar goes down, the Euro goes up in value thereby hurting the European export market since the European goods are more expensive than the U.S. counterparts. Nobody wants their currency to go up in value right now because they need the export business. All currencies are losing value relative to gold but the dollar is losing ground at a faster clip. As the value of the U.S. dollar declines, the relative wealth of Americans’ assets decline.

U.S. Deficits

The Obama Administration is projecting a $1.5 Trillion deficit this coming year. By 2019 the deficit will be unsustainable and the interest expense will consume domestic tax receipts. The consumer is de-leveraging his debt load and is no longer in the mood to buy in excess. The U.S. stock market will be watching Black Friday, the day after Thanksgiving, to see how bad the Christmas spending season will be. Reduced spending will reduce tax receipts and payrolls of retail oriented companies. November 30th could be an ugly day on Wall Street if retailers don’t make their numbers.

Commercial Real Estate

The next bubble to burst is the commercial real estate. The retailers that are barely holding on hoping for a reasonable Christmas bump will be closing their doors in January with fire sale prices to cash out of their remaining inventory. Amazon.com will be the glimmer of hope since consumers will become efficient shoppers by necessity. Though not as big as the housing bubble, the ripple effect of the commercial real estate foreclosures will force asset devaluation to continue.

Unemployment

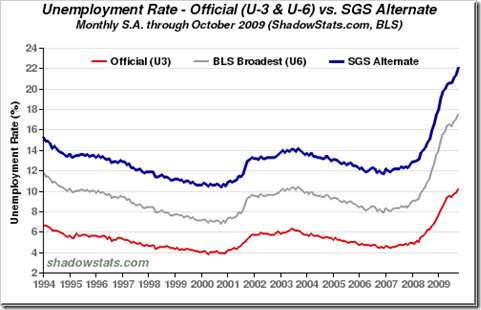

22.1% is the realistic number. Let’s face it, we all know people unemployed or severely underemployed. The following graph says it all:

When we need “real” numbers, the statisticians are reporting “cooked” numbers with optimistic bias. The economic stimulus is not creating infrastructure to support ongoing growth where new jobs are created.

Summary

As Christians, we are to walk by faith, not by sight. Economic calamity will bring people back to a focus on Our Heavenly Father. Self-interest has been the focus of the average American, not Love and service to others. The coming period will be painful for many but those who have been called by Our Heavenly Father to minister life to others will be quite busy. I expect repentance to replace arrogance and The Lord’s Prayer will become a sincere petition: Thy Kingdom come, They Will be done, on earth as it is in Heaven!