From Wikipedia, the free encyclopedia: The Texas ratio is a measure of a bank’s credit troubles. Developed by Gerard Cassidy and others at RBC Capital Markets, it is calculated by dividing the value of the lender’s non-performing loans by the sum of its tangible equity capital and loan loss reserves. In analyzing Texas banks during the early 1980s recession, Cassidy noted that banks tended to fail when this ratio reached 1:1, or 100%. He noted a similar pattern among New England banks during the recession of the early 1990s.

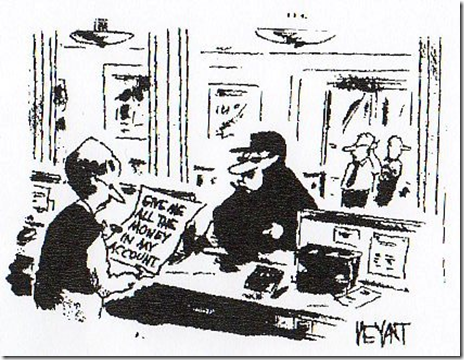

Expect to hear more about the Texas ratio in upcoming months. The FDIC has been gearing up for more than a year to handle the coming bank failures. The Federal Reserve has been helping the biggest banks since they are "too big to fail". The New York Attorney General is settling with the big investment banks by forcing them to buy back their "auction rate" securities and slapping fines on them. Hmmm! There’s not much talk about jail time! I guess you can be too big to go to jail for fraud. Money talks, everyone else walks (to jail).

After Indymac, the FDIC has about $37 Billion left in its war chest. That will not be enough. You and I will open our taxpayer wallets and fund some more fraudulent behavior. There have been three bank failures since Indymac although you don’t hear much about those failures. Friday after 5PM is the standard timetable to close a bank. Generally, the FDIC has another bank to take the depositors and opens up on Monday as the new bank. The new bank is not liable for any deposits of the failed bank, the FDIC is.

See: http://www.statesman.com/business/content/shared/money/stories/2008/08/fdic_0824_1.html

Don’t worry about your money, the boys up in D.C. are looking out for your best interest.

We are facing a tremendous "moral hazard" now. The Fed is sending signals that when times are good, financial institutions get to keep and distribute their profits to top execs and stockholders. When times are bad, the same financial institutions are able to go to the Fed’s begging bowl. These institutions provide political contributions and expect payback when times are tough. The currency used is taxpayer money.

See: http://ap.google.com/article/ALeqM5h04hnO_iYHQ4URCW-gqOIJ0pMGRwD92O3QHG0

The Detroit auto manufacturers want in on the action too:

http://money.cnn.com/2008/08/23/news/economy/auto_bailout.ap/index.htm

$50 billion here, $50 billion there…. before long we’re talkin’ real money!

We are in unprecedented times of unequal weights and measures. How far down this path are we? It would appear that we will soon reach a flashpoint when the house of cards (or Federal Reserve Notes) comes tumbling down. Gold is the barometer. The central banks know this and that is why there is an orchestrated effort to keep the price below $1000. However, once things began to head south each central bank will fend for itself.